In recent years, the global economic landscape has been undergoing significant shifts, particularly with the rise of the BRICS nations—Brazil, Russia, India, China, and South Africa. This coalition represents a substantial bloc in the world economy, aiming to enhance cooperation among emerging economies and provide a counterbalance to Western financial dominance. A central theme in these discussions is the potential for a unified BRICS currency, which raises critical questions about the future of the US dollar, long considered the world’s primary reserve currency.

The potential establishment of a BRICS currency has become a focal point for discussions at recent summits, particularly following key geopolitical events that have challenged the existing financial order. As the BRICS nations explore ways to strengthen their economic ties and reduce reliance on the US dollar, the implications for global trade dynamics are profound. This article delves into the current status of the BRICS currency discussions, the challenges posed by the US dollar, and the potential for a multipolar financial system.

The BRICS Currency: Aspirations and Realities

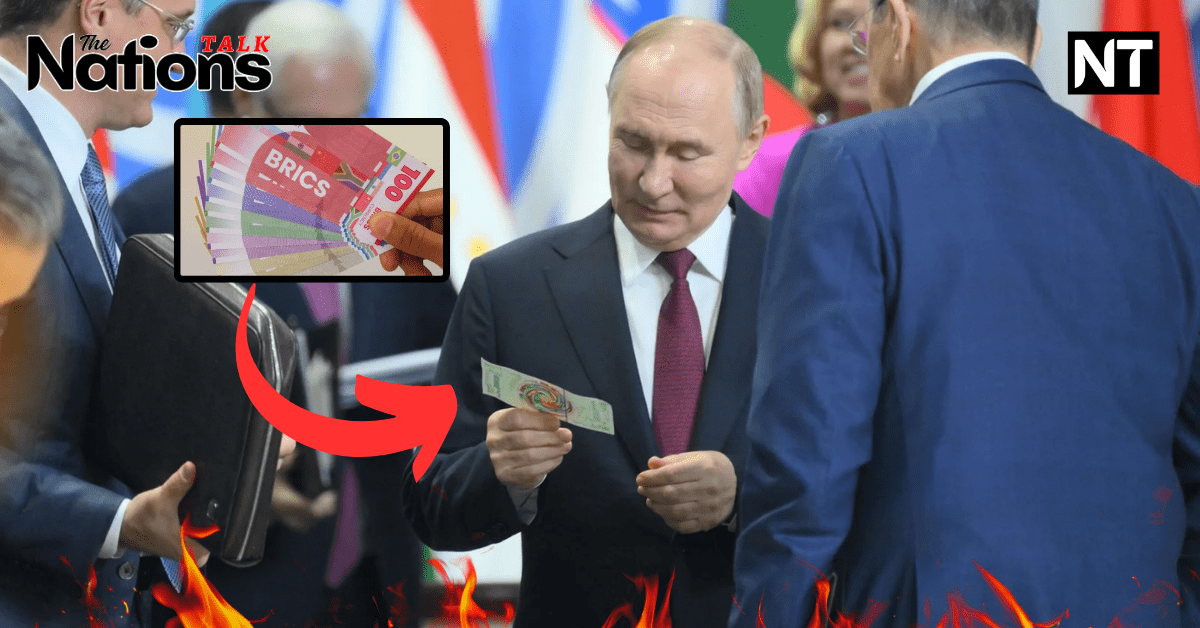

The buzz surrounding the BRICS currency gained momentum after Russian President Vladimir Putin showcased what was initially believed to be the first BRICS currency note during a recent summit. This moment sparked widespread speculation about the emergence of a new economic order. However, it was later clarified that the note was a gift, not an official representation of any upcoming currency. Nevertheless, this symbolic moment highlighted the aspirations of BRICS nations to redefine their economic relationships.

Currently, the BRICS currency exists more as a concept than a tangible reality. The discussions around a common currency are gaining momentum as member countries recognize the need to facilitate trade without relying solely on traditional systems like SWIFT. The recent sanctions imposed on Russia have intensified this urgency, highlighting the vulnerabilities of relying on the US dollar and traditional financial systems.

Understanding the Geopolitical Landscape

The geopolitical landscape has become increasingly complex. The BRICS nations collectively represent a substantial portion of the world’s population and economic activity. Historically, the US dollar has maintained dominance, accounting for approximately 88% of international transactions and around 58% of global foreign exchange reserves. This level of control has often been weaponized by the United States, particularly through economic sanctions, prompting other nations to reconsider their financial dependencies.

The upcoming BRICS summit in Kazakhstan comes at a crucial time for these nations. The relationships among them may see notable improvements compared to the past, as they discuss strategies to counter the dollar’s influence in international trade. A central theme of this summit will revolve around how BRICS nations can protect themselves from the US dollar, which has often been wielded as a financial weapon by the United States.

Putin’s Perspective: A Call for Alternatives

Putin has been vocal about the global sentiment surrounding the value of the dollar, particularly following the sanctions imposed on Russia after the Ukraine war. This scenario has led to growing discussions among countries like India and China about the need for alternatives to the dollar for trade purposes. The pressing question remains: can BRICS develop a strategy that effectively diminishes the dollar’s dominance in global trade?

A significant topic of discussion is the need for alternatives to the SWIFT system, which facilitates international transactions. Following Russia’s exclusion from SWIFT, there has been an urgent need for a new system that would allow BRICS nations to conduct trade without reliance on the dollar. However, without a strong and universally accepted currency, establishing such a system may prove difficult.

Currency Challenges: The Case of the Yuan

China’s approach to trade exemplifies these challenges. For example, China has been purchasing crude oil from Russia using the Chinese Yuan. While this strategy demonstrates a move away from the dollar, it raises questions about what Russia can do with the Yuan it receives. The limited international acceptance of currencies like the ruble complicates these trade dynamics. While China has successfully navigated this by trading in Yuan, the effectiveness of this strategy for Russia remains uncertain, as there are limited avenues for using these Yuan in international markets.

Historically, the US has effectively leveraged the dollar as a weapon in its economic arsenal to influence global trade dynamics. Currently, approximately 88% of international transactions are conducted in dollars, and around 58% of global foreign exchange reserves are held in the same currency. This dominance poses a significant barrier for any potential challenger to the dollar’s supremacy.

The Idea of a Unified BRICS Currency

In response to the dollar’s weaponization, discussions have emerged about the possibility of creating a BRICS currency, similar to the Euro. However, establishing a unified currency for the BRICS nations would be a challenging task given the diverse economic conditions and monetary policies of the member countries. Instead, the immediate focus may be on finding alternatives to the SWIFT system and promoting trade using local currencies among BRICS nations.

The concept of de-dollarization has gained traction in light of recent geopolitical events. Countries are increasingly aware of the risks associated with dependence on the dollar for international trade. With the rise of a multipolar world, it is essential for BRICS nations to explore how they can create a more resilient economic framework.

Future Prospects: A Multipolar Financial System

As the global economy shifts towards a more multipolar structure, the financial system may also need to reflect this change. However, the current state of affairs suggests that the US dollar’s dominance is unlikely to be challenged anytime soon. The upcoming BRICS summit could provide insights into how these countries plan to tackle these challenges and whether significant changes will be announced regarding their economic collaboration.

Local currencies present an interesting avenue for BRICS nations. For instance, India has engaged in trade with Russia using the rupee, which offers a model for how other BRICS nations might also operate. This approach not only strengthens economic ties among member states but also enhances their bargaining power in global markets.

However, challenges remain. Ensuring that local currencies are accepted and can be utilized effectively in global markets is a major hurdle. The success of this strategy hinges on building confidence in these currencies and creating mechanisms for their wider acceptance.

The Broader Context of Dollar Hegemony

Moreover, there is a broader context to consider regarding the US dollar’s position as the world’s primary reserve currency. The US dollar’s dominance has allowed the United States to exert considerable influence over global economic policies. The ability to print currency and run trade deficits without immediate repercussions has been a significant advantage. This financial hegemony has led other countries to question the sustainability of their reliance on the dollar.

The economic sanctions imposed by the US on various countries have prompted discussions about the need for alternatives to the dollar. Countries like Russia and China are advocating for the development of a new financial architecture that can operate independently of the US dollar. This sentiment is echoed in the upcoming BRICS discussions, where leaders will deliberate on how to bolster economic cooperation and explore avenues for trade that do not involve the dollar.

Strengthening Intra-BRICS Trade

One notable aspect of the discussions will likely focus on creating mechanisms for intra-BRICS trade. By promoting trade among member countries using their local currencies, BRICS can reduce their dependence on the dollar. This approach not only strengthens economic ties among member states but also enhances their bargaining power in global markets.

Furthermore, the idea of a BRICS digital currency has gained traction. Digital currencies have revolutionized the financial landscape, and a BRICS digital currency could enable quicker and more secure transactions among member nations. This innovation could foster greater economic integration and attract investment from outside the bloc.

The Complexity of Transitioning Away from the Dollar

It is essential to recognize that while there is a push for alternatives, the transition away from the dollar will not be instantaneous. The current global economic landscape is deeply entrenched in dollar-denominated transactions, making any shift a complex process. However, the growing momentum for change suggests that BRICS countries are serious about exploring new financial frameworks.

The complexity of this transition is underscored by the fact that while countries are looking to trade in local currencies, they still face significant challenges related to liquidity, stability, and acceptance in the global market. Establishing trust in these currencies is paramount for their success in international trade.

The Kazakhstan Situation and Geopolitical Intricacies

The situation in Kazakhstan exemplifies the geopolitical intricacies involved in the BRICS framework. Russia’s encouragement for Kazakhstan to join BRICS was met with resistance, leading to tensions and even bans on agricultural products from Kazakhstan. This incident underscores the complexities and power dynamics at play within BRICS, where larger economies may exert influence over smaller members. It also highlights the challenges of achieving a unified front among diverse nations.

Another interesting aspect is the proposed design of the currency itself. Leaked designs and concepts have sparked debates about what symbols and figures should represent the BRICS alliance. Many believe that the design should reflect the cultural diversity and economic strengths of the member nations. This discussion ties into larger themes of national identity and how each country views its role within the BRICS framework.

Economic Implications of a BRICS Currency

The potential establishment of a BRICS currency could have significant economic implications not just for member countries, but for the global economy as a whole. A common currency would facilitate easier trade between member nations, potentially increasing economic cooperation and reducing reliance on the US dollar. This shift could challenge existing power dynamics in global finance and signal a new era of economic collaboration among emerging economies.

Moreover, the ongoing discussions surrounding a BRICS currency are not just about economic mechanics but also about the future of international relations and the balance of power in a rapidly changing world. As member countries work towards enhancing their economic independence, they must navigate the complexities posed by traditional financial systems while striving for a cohesive vision.

Conclusion: A Pivotal Moment for BRICS

In conclusion, the discussions surrounding a BRICS currency raise important questions about global trade, national identity, and economic collaboration. The ongoing dialogue surrounding this concept highlights the ambition of member nations to enhance their economic independence while navigating the challenges posed by traditional financial systems.

As the world stands at a crossroads, the potential for a BRICS currency, or even a BRICS digital currency, signals a growing interest in reimagining global trade dynamics. The next few years will be pivotal in determining whether this ambitious project can materialize and what it will mean for the future of international trade and economic cooperation among BRICS nations.

As these conversations progress, it will be crucial for member nations to establish a common vision and address the complexities that arise from their diverse economic landscapes. The upcoming BRICS summit holds significant potential for shaping the future of international trade and finance, as member countries grapple with the implications of dollar dominance and seek innovative solutions to enhance their economic sovereignty.

Call to Action

As readers reflect on the implications of a potential BRICS currency, it is essential to stay informed about the developments in global economics. Understanding these dynamics can empower individuals, businesses, and policymakers to navigate the evolving landscape and engage in informed discussions about the future of international trade and finance.

In a world increasingly characterized by multi-polarity and economic interdependence, the aspirations of the BRICS nations may well redefine the global economic order, paving the way for new forms of collaboration and innovation in trade.